I am excited to share a story about my next millionaire student and I’m proud to have several millionaire trading challenge students already, some of whom who prefer to remain private, but thankfully some of whom share their stories publicly to help inspire others like my first millionaire student here (who was also my first online hater so if I can teach him I can teach ANYONE!), my 2nd millionaire student HERE (who was also featured here by a bigtime media site) and my 3rd millionaire student HERE (who had quite a viral video interview here)…and now I have an upcoming millionaire trading challenge student on the brink of crossing $1 million in profits…**

I’ve already featured him HERE as I treated him to some courtside NBA seats to his favorite team, the San Antonio Spurs (and we also got to have dinner with NBA legend David Robinson, which you can see HERE) and he’s done several great videos like these before:**

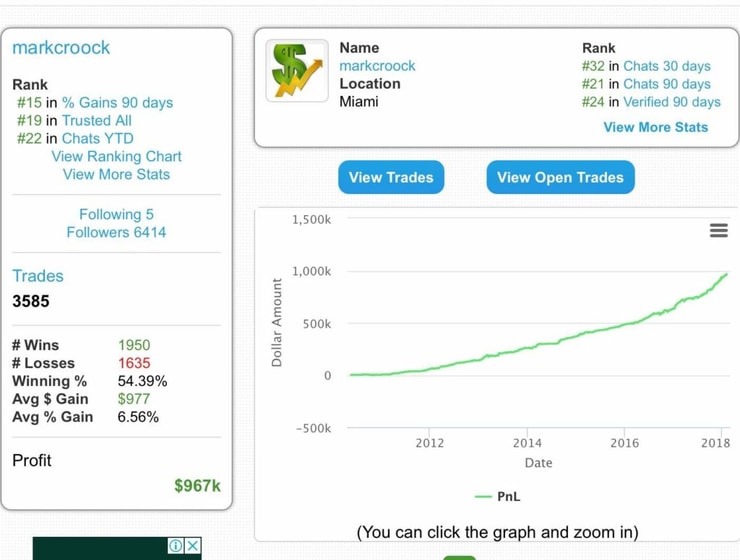

And my trading challenge students know him well because he gives weekly webinars, helps me mentor other students and he’s now made 300+ video lessons exclusively for trading challenge students, not to mention he’s the one responsible for categorizing ALL my 5,500+ video lesson library (since he was the first to watch them ALL 3x over…in case you lazy people ever wanted to know what it took to become my next millionaire trading challenge student, watching ALL my video lessons multiple times can only help increase your odds of success), and now after several years of truly hard work, study and LOTS of trading, he’s closing in on $1 million in profits with $967,000 in trading profits:**

Not to mention over the past few years as the stock market helped change his life, he also moved to Miami, got married to an incredible girl (I was fortunate enough to attend their beautiful wedding!) and he also just had a beautiful baby too even as his financial life has changed dramatically since he found my strategy while working as an accountant in a cubicle several years ago.**

Here’s a little interview my team did with him too a little while, I’m not even sure we ever posted it because the past few years have been crazy for me too, as every new millionaire trading challenge student who show ALL their trades publicly, not like the BSers who just show a screenshot or two that are too easily doctored/photoshopped, helps show why I’m really in an industry full of frauds…just a little reminder to be VERY careful with those who claim to have made millions of dollars, ask them to show proof (like I do here) and also ask to talk to their top students, make sure they’re not just fake people with fake names created on the Internet (as several scumbag wannabe gurus have been known to do)

1. How long have you been trading?

I began trading in mid-2010 so I have several years of trading experience.

2. How did you find out about Tim Sykes?

I watched a few Youtube videos here about Tim’s story back in 2010 and became very interested in penny stocks once I learned more about his strategy!

3. How has your life been impacted by your success?

I was able to walk away from a career in Accounting where I was dying a slow death behind the desk. Now I’m able to work from home as my own boss and “live the dream” while helping new trading students who are dedicated to learning and motivated to consistently profit in the penny stock markets!**

4. What is the most important lesson that Tim has taught you?

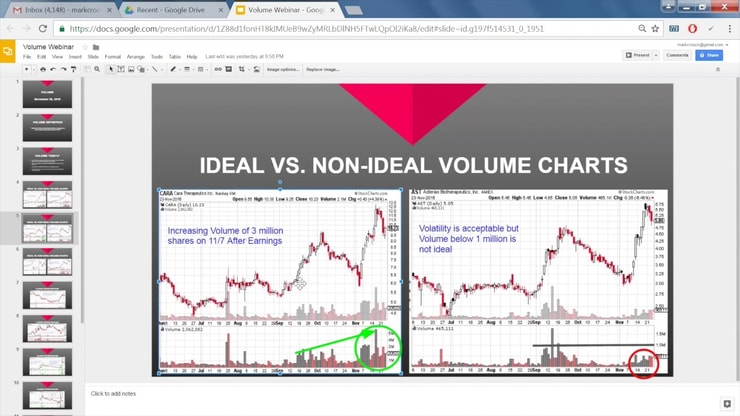

Focus on the ideal setups that present great “risk/reward” and meticulously execute your trades while cutting losses quickly in order to consistently grow your account year in, year out. Ignore the unpredictable setups and avoid over-trading.

5. What did you have to overcome to get to where you are at today?

Many people, including family and friends, have told me that trading is gambling and is far too risky to practice for a living. Knowing that 90% of traders fail is, in a sense, a psychological barrier to success. I had to find a way to “beat the odds” so I joined the Tim Sykes Trading Challenge and studied Tim Sykes’ strategy day and night (watching every DVD and video lesson he’s ever made). Now I’m “self-sufficient” and happily teaching many of my own students who need personalized coaching in Tim’s trading challenge!**

6. Keys to your success so far as a trader?

Staying disciplined is the most important factor in my success. I have learned to accept losses and move on when I’m wrong. It’s absolutely critical to stay on the sidelines when there are no setups in order to avoid forcing trades that will likely end up as losers.

7. What advice would you give a new trader?

Find a mentor that will help guide you through the ABC’s of trading (technical analysis, psychology, and ideal setups). Understand your strengths and weakness by trading small position sizes when you start out. Never blindly follow someone else’s trades – use them as a learning tool so you can ultimately make your own decisions! I can definitely help you through this process and that’s why I’m so proud to be one of the mentors in Tim’s trading challenge!

Understand that Mark is not a millionaire yet, as he also has to pay taxes on his trading profits (go here if you want to tackle that subject I don’t teach it, but I know someone very qualified who does) and I don’t know exactly when he will cross $1 million as I’ve learned from past millionaire trading challenge students not to get ahead of myself and try to force the issue (as once upon a time I brought a whole camera crew to witness Tim Grittani passing $1 million in profits and because of the pressure, he promptly lost $50,000 instead of making it so I won’t make that mistake again!), but I’m sure that as long as Mark continues taking it one trade at a time, he will be my next millionaire trading challenge student so do me a favor and leave a comment below congratulating him on his journey so far and thanking him for sharing his lessons along the way so openly with other students too!**

Leave a reply